How Economics and Strategic Tokenomics Create Compounding Value

In the world of blockchain infrastructure, most projects follow a predictable pattern: build a product, launch a token, generate hype, and watch adoption flatline. This linear “pipeline” model has created thousands of projects but precious few lasting successes. All in all, because they’re playing the wrong game entirely.

The most valuable companies in the world today—like Amazon, Apple, Microsoft, Alphabet—don’t operate as pipelines. They’re platforms and not just product sellers. The most successful companies orchestrate ecosystems where value compounds through network effects, and success compounds exponentially rather than accumulating linearly.

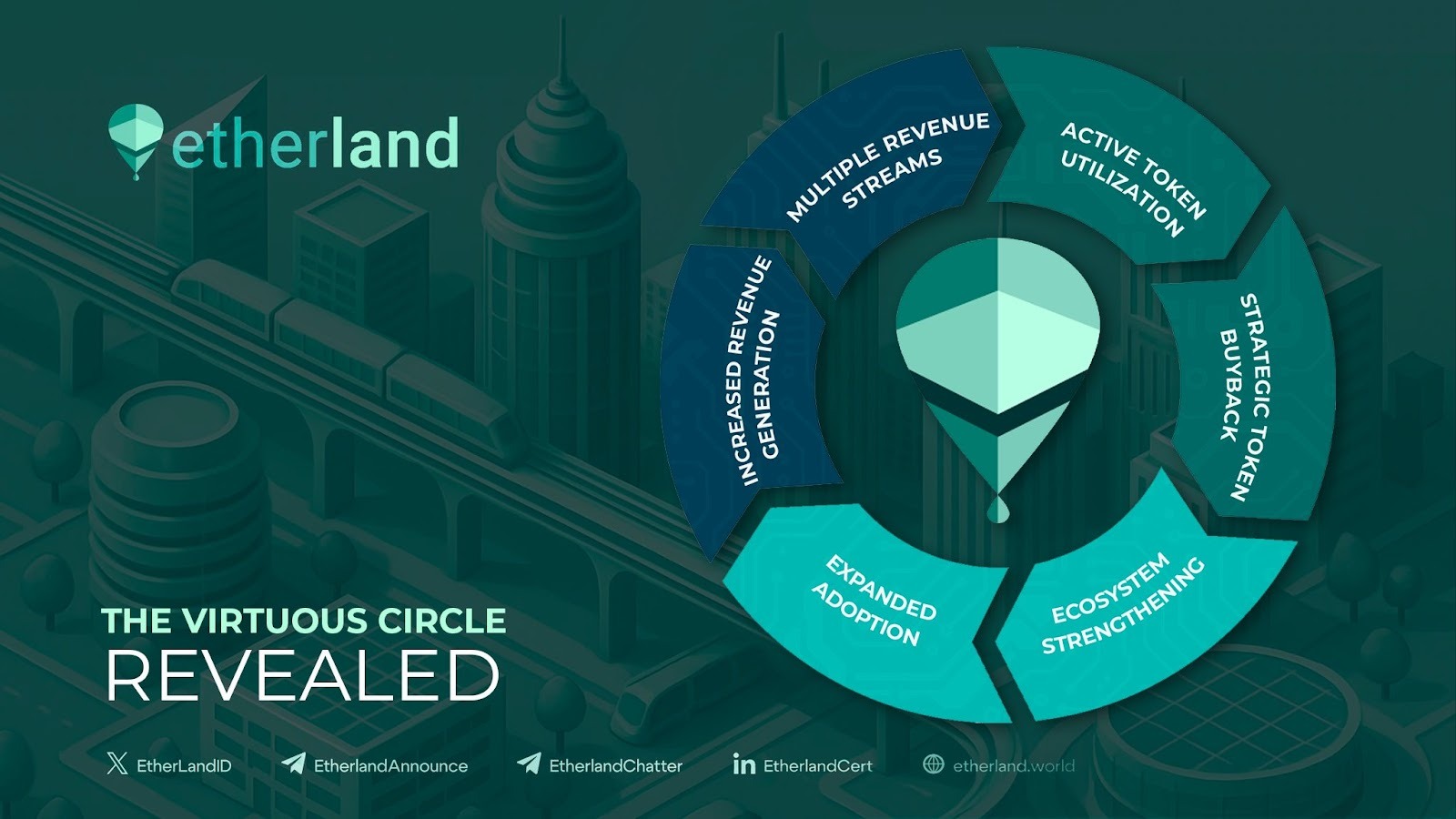

In this piece, we’re revealing why Etherland V2 operates fundamentally differently from typical blockchain projects, through a self-reinforcing virtuous circle where each component strengthens the others, driving sustainable growth and shared value creation. Welcome to the architecture that enables sustainable Web3 infrastructure.

The Platform Model: Linear vs. Exponential

Foremost, we want to highlight that this isn’t a theoretical platform economics borrowed from business school textbooks. We are sharing our operational blueprint for transforming blockchain infrastructure from speculation to production, from isolated applications to interconnected ecosystems, from linear growth to exponential compounding.

Traditional businesses create value linearly—by controlling production and scaling through increased output. Meanwhile, platform businesses operate differently, facilitating exchanges between participant groups, creating network effects where each additional user increases platform value for everyone. More drivers make Uber valuable to riders; more riders attract more drivers. This positive feedback loop creates exponential growth impossible in linear models.

Etherland V2 is a technology hub with multiple spokes across real estate, wealth management, cultural heritage, and enterprise infrastructure, transforming value flow from linear to circular, competitive to collaborative, and isolated to interconnected.

At the center sits $ELAND, the economic mechanism connecting all ecosystem components. Unlike tokens that exist primarily for trading, it has functional utility across every vertical, powering MyCompliance ESG reports, enabling MyAttendant access controls, incentivizing Cultural Heritage contributions, and governing Launchpad integrations. Users acquire $ELAND because they need it to access infrastructure. Therefore, appreciation happens as a consequence of utility, not as a primary purpose.

The Virtuous Circle: Six Stages

Stage 1: Multiple Revenue Streams: such as proprietary verticals (MyCompliance, MyAttendant, Heritage Platform) address $5.85T ESG, $10T+ family office, and $45B heritage markets. B2B module licensing serves the multi-trillion infrastructure opportunity

Stage 2: Active Token Utilization: $ELAND flows through operational applications daily. Every transaction integrates tokens for platform access, creating feedback loops influencing adoption patterns and ecosystem sustainability: an organic demand divorced from speculation.

Stage 3: Strategic Buyback: 10% of quarterly profits fund systematic buybacks. Crypto projects spent $1.4B on buybacks in 2025, with leaders demonstrating effectiveness: Hyperliquid generated $716M annualized buy pressure (46% of all activity), Jupiter commits $250M annually, and Raydium repurchased 26.4% of supply. Moreover, another interesting fact outlines that buyback programs outperformed non-buyback projects by 46.67%. Our automated, revenue-backed approach creates sustained demand while reducing supply.

Stage 4: Ecosystem Strengthening: Enhanced token value strengthens the foundation. Users benefit from appreciation, developers find grants more lucrative, enterprises see holdings provide utility and growth, platforms attract more participants, creating digitally enabled value networks where platform value exceeds component sum.

Stage 5: Expanded Adoption: Once platforms achieve critical mass, network externalities create substantial switching costs while attracting new participants. More firms adopt MyCompliance, more high-net-worth individuals trust MyAttendant, more enterprises license modules, and more developers launch applications. Therefore, cross-vertical synergies multiply. Highest market share platforms win long-term, creating winner-takes-all dynamics.

Stage 6: Increased Revenue: Greater adoption generates additional revenue, increasing buyback volume, completing the circle. Compounding becomes exponential. Platform businesses scale this way—top 15 public platforms worth $2.6T through compounding dynamics.

Why This Creates Unstoppable Momentum

The architecture creates shared success where every vertical win feeds the entire ecosystem as token demand rises, all participants prosper together rather than competing for finite value. When developers build on our platform, they’re reinforcing the very foundation their applications depend on, turning potential competitors into ecosystem strengtheners.

The economics are anti-fragile by design. Diversified revenue across verticals, plus 60% infrastructure cost savings, creates resilience where, if one market cools, others heat up. Operational utility persists regardless of speculation cycles, ensuring sustainability through all market conditions.

The five-year trajectory progresses systematically: Q1 2026 launches ELAND V2 with 84% liquidity, immediately followed by MyAttendant entering the $10T+ wealth management market. The Launchpad activation brings third-party developers into the ecosystem, scaling through 2027-28 to 100+ enterprise clients across verticals. By 2030, our platform is expected to reach 1M+ users, generating $5M+ revenue at 30%+ margins. Every milestone amplifies the virtuous circle’s velocity, creating compounding momentum that becomes exponentially harder to replicate or compete against.

Your Place in the Virtuous Circle

The power of the Etherland platform economics blueprint is proven across every major digital transformation of the past two decades. From Amazon’s marketplace to Uber’s transportation network to Airbnb’s hospitality platform, such platforms don’t just compete with traditional businesses as they render traditional business models obsolete through superior economics and compounding network effects.

Etherland V2 brings this same platform advantage to blockchain infrastructure. Our virtuous circle transforms Web3 from speculation to sustainable value creation, from isolated applications to interconnected ecosystems, and from linear growth to exponential compounding.

The virtuous circle is spinning: revenue is being generated across multiple streams. Buybacks are executed systematically, and network effects are compounding with each new participant. Token utility is expanding across verticals, and the infrastructure is strengthening daily.

But here’s what matters most: we’re still in the foundation stage. The compounding effects that will eventually create insurmountable competitive advantages and extraordinary value are just beginning. Early participants in platform ecosystems capture disproportionate value precisely because network effects intensify with scale.

For Token Holders: You’re not holding a speculative asset but actually participating in a self-reinforcing system designed to create long-term value through operational utility, strategic buybacks, and network effects. Every quarter, revenue funds buybacks that reduce supply, and that, in turn, enhances scarcity. Every enhancement attracts new participants, and as a result, the circle spins faster.

For Developers: You’re not licensing static infrastructure, but building on a platform that improves with every application, shares success across all participants, and compounds value through cross-vertical synergies. Your success strengthens the foundation you build upon.

For Enterprises: You’re not purchasing a service but accessing a platform that reduces your costs drastically by double-digit %, strengthens with every adoption, and aligns incentives for mutual success. Your participation benefits from and contributes to ecosystem network effects.

For Users: You’re not consuming isolated services, but joining an ecosystem where your participation makes the platform more valuable for everyone while your token holdings appreciate through organic demand and strategic buybacks. Every transaction, every interaction, every contribution strengthens the circle.

The question facing anyone evaluating blockchain infrastructure isn’t whether platform economics will transform the space—the evidence is overwhelming. Will you be part of the transformation while the circle accelerates, or will you watch from the sidelines as network effects create barriers to entry?

Platform businesses don’t succeed because they’re the best product. The truth is, once network effects reach critical mass, they become the only rational choice. Uber isn’t successful because their app is marginally better, but they’re successful because everyone uses Uber. The circular logic is the entire point.

We’re building that same inevitability into blockchain infrastructure. The virtuous circle is our blueprint, the compounding effects are our competitive moat, and the aligned incentives are our sustainability guarantee.

The platform economics are our path to dominance. This is your invitation to enter the virtuous circle at its foundation stage—before compounding effects create the value barriers that reward early participants and exclude late arrivals.

The future of blockchain infrastructure isn’t isolated applications competing for attention. We foresee and envision it as integrated platforms creating exponential value through network effects. Moreover, pipeline businesses with linear growth don’t have a market fit in this, but platform businesses with compounding returns do.

The future is the virtuous circle. Welcome to Etherland V2.

To learn more about our platform architecture, review our partnerships, or explore joining the ecosystem as a developer, enterprise client, or community member:

Want to know how our products can fit your needs? Have a financial solution to help us build? Book your meeting here!